Our specialist teams are integrated across the business where they can best apply their expert skills to upholding our commitment to outstanding customer service.

Each plays a major role in upholding our commitment to deliver benefits for all Victorians, and supports our frontline staff and revenue experts.

Notable achievements in 2015-16 to assist customers included:

- Exceeding a Statement of Expectations requirement to increase Duties Online password resets to 80 per cent (we achieved 92.3 per cent),

- Supporting administration of the Back to Work Scheme, Absentee Owner Surcharge and Foreign Purchaser Additional Duty,

- Delivering a successful strategy to significantly enhance service quality for land tax customers, including introducing first-call resolution for amendments to assessments,

- Improving the convenience for customers to lodge and assess their transfer documents exclusively online, by expanding our suite of services to include all transactions, and

- Exceeding our target for customer phone calls, answering more than 82 per cent of 268,529 calls within 300 seconds

Policy and legislation

We support a range of revenue management functions by developing practical solutions to complex policy problems. This principally includes working closely with stakeholders including the Department of Treasury and Finance, and the Office of the Chief Parliamentary Counsel, to assist in the development of the legislation we administer.

In-house support is provided to assist SRO officers in their understanding of policy design of the state taxes regime, and as a key liaison point for our inter-jurisdictional colleagues in the areas of harmonisation and collaboration.

Our specialists also provide the lead function for information, privacy, Human Rights Charter and Ombudsman issues.

In 2015-16, notable legislative work included the introduction of:

- The State Taxation Acts Further Amendment Act 2015, which included:

- Updated requirements for the payroll tax exemption for group training organisations, and

- Amendments to the Valuation of Land Act 1960, which allow the apportionment of valuations in particular circumstances, and reform how and when the Valuer-General is able to make site valuations that can be used for land tax purposes

- The State Taxation and Other Acts Amendment Act 2016, which included:

- Budget announcements that increased from 3 to 7 per cent duty the surcharge on the transfer of residential property to a foreign purchaser from 1 July 2016; increased from 0.5 to 1.5 per cent the land tax surcharge on land owned by an absentee owner from the 2017 tax year; extended the primary production land tax exemption to land owned by a family superannuation fund; and increased the payroll tax threshold of $550,000 by $25,000 annually to $650,000 by 2019-20 from 1 July 2016 and provided an exemption from payroll tax in respect of wages paid to a displaced apprentice or trainee,

- Clarification of the meaning of residential property for the purposes of the foreign purchaser additional duty and making unpaid duty a first charge on land, and

- Amendments that facilitate the efficient and prompt collection of debts under the First Home Owner Grant Act 2000, and allow for FHOG information to be provided to the Ombudsman

- A new provision to allow the SRO to provide information to local councils that collect the Fire Services Property Levy on properties located outside their municipal boundary.

- The Land Tax Regulations 2015, which set the fee payable for a land tax clearance certificate, and the information required on a notice of acquisition of land. The Regulations were supported by a Regulatory Impact Statement, and public consultation, to ensure they best serve the Victorian community.

Objections and private rulings

We issue private rulings and determine objections for all revenue lines we administer.

Our technical experts also strive to ensure that the complexities of the taxation legislation we administer are clearly and concisely communicated at all levels.

In 2015-16, notable achievements included:

- 1308 objections determined to 3350 assessments (87 per cent completed within its 90-day KPI), and

- 921 private rulings or exemption request decisions issued (87 per cent completed within 90-day KPI), including determining more than 100 applications for exemption from the new foreign purchaser additional duty and land tax absentee owner surcharge provisions

Litigation and appeal resolution

Each year we assess and process hundreds of thousands of transactions, including applications for exemptions and grants.

The vast majority of these decisions are undisputed, however, a small percentage is objected to by customers who question whether a particular situation attracts a tax liability or dispute their eligibility for a concession/exemption.

In these circumstances where we are unable to reach an internal resolution, customers may seek to have their matter determined by the Victorian Civil and Administrative Tribunal (VCAT) or the Supreme Court. In 2015-16, we received 108 requests seeking referral of a matter to VCAT or the courts (including appeals by either party).

Our legal specialists generally resolve approximately two-thirds of cases without the need for litigation. However, some remaining matters can only be resolved by substantive hearings (including matters on appeal). In 2015-16, the Commissioner’s original decisions/assessments were substantially upheld in 84 per cent of cases.

Technology

Protecting our data and the privacy of customers are critically important to us.

In 2015-16, our ongoing active management program addressed the risk of cyberattacks and maintained the health and security of SRO systems.

We also conducted a review of our cybersecurity strategy, initiating plans for a number of new projects to further strengthen the security of our systems and ensure our customers are protected.

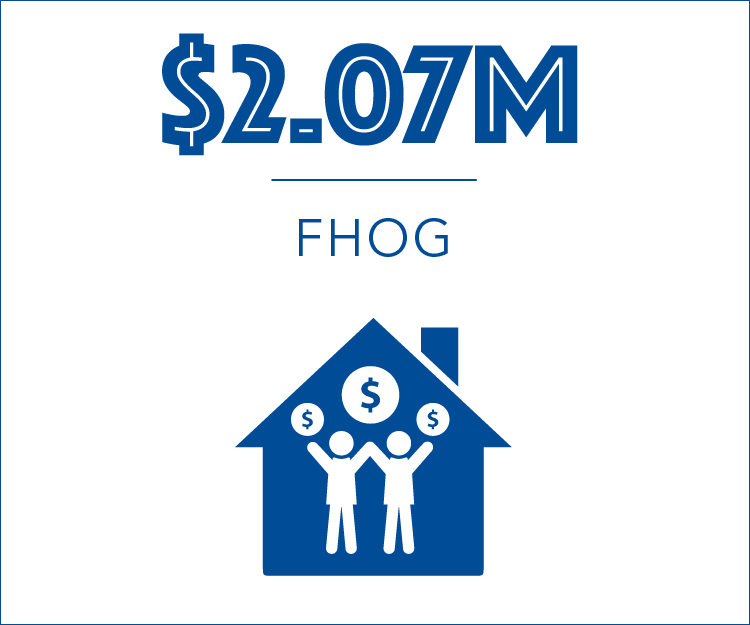

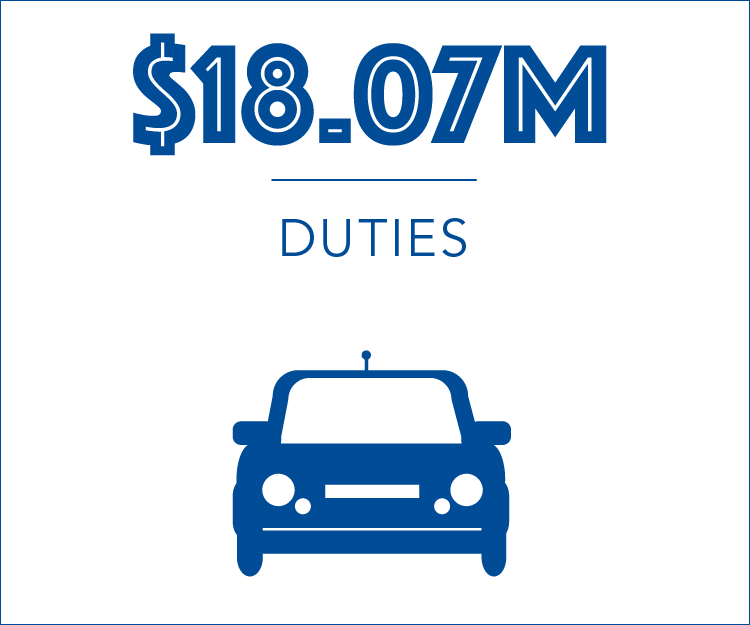

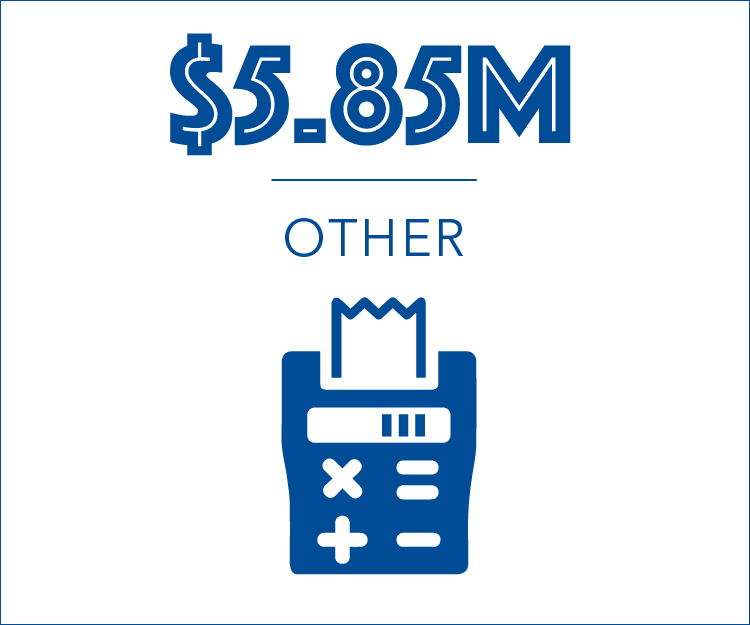

Compliance

Detecting cases where taxpayers are not meeting their obligations relies largely on accessing and cross-matching accurate and timely information.

Our expert teams accomplish this with sophisticated data-matching technology and ongoing agency collaboration. This approach is both effective and efficient, with 96 per cent of these cases revealing liabilities in the past year, up from 87 per cent in 2014-15. Supporting this is our overall strategy to maximise voluntary compliance through education and assistance so that customers can pay the right amount of tax at the right time.

Consequently, in 2015-16 our compliance teams assessed $361 million in outstanding liabilities from just over 10,600 cases and investigations.

In addition, we also:

- Made determinations of 165 acquisition statements, 126 landholder/land rich ruling requests and 84 lease ruling requests,

- Delivered public education seminars on the provisions to legal and tax practitioners, and

- Made determinations of nine trust registration applications under the landholder provisions