While the overwhelming majority of our customers meet their obligations, there is inevitably a small level of debt that we must manage.

Nevertheless, a comprehensive review of our debt management strategies identified efficiency gains in how we recover debt. In 2015-16, work commenced to develop specific enhancements, including a flexible online payment arrangement system to make it easier for customers to do business with us.

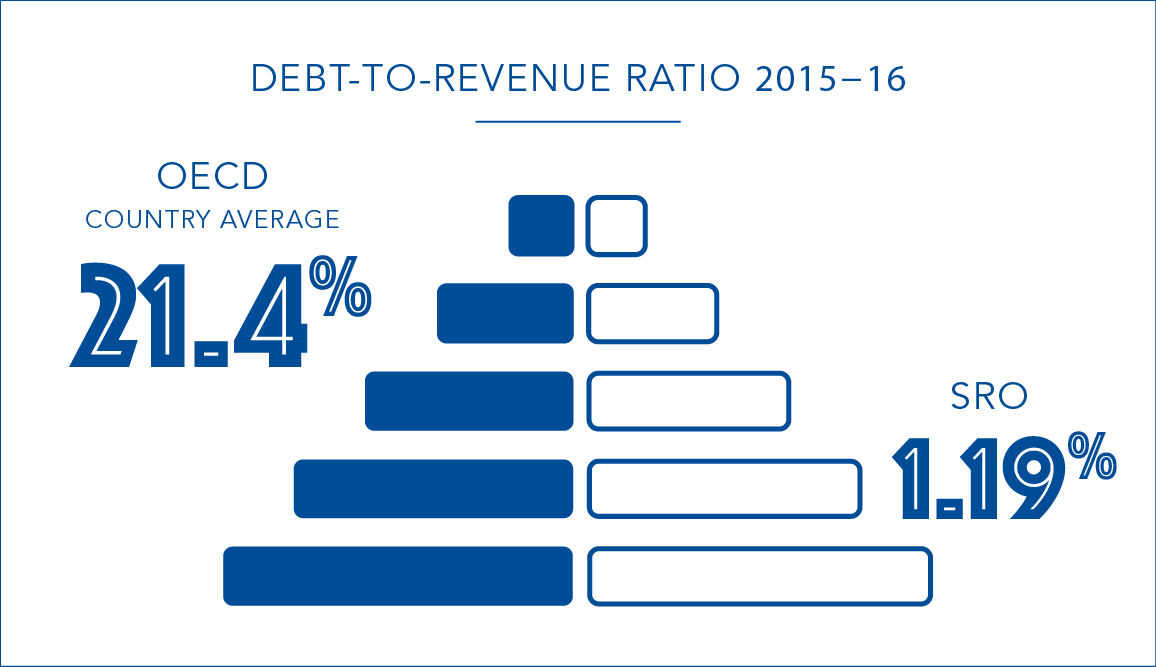

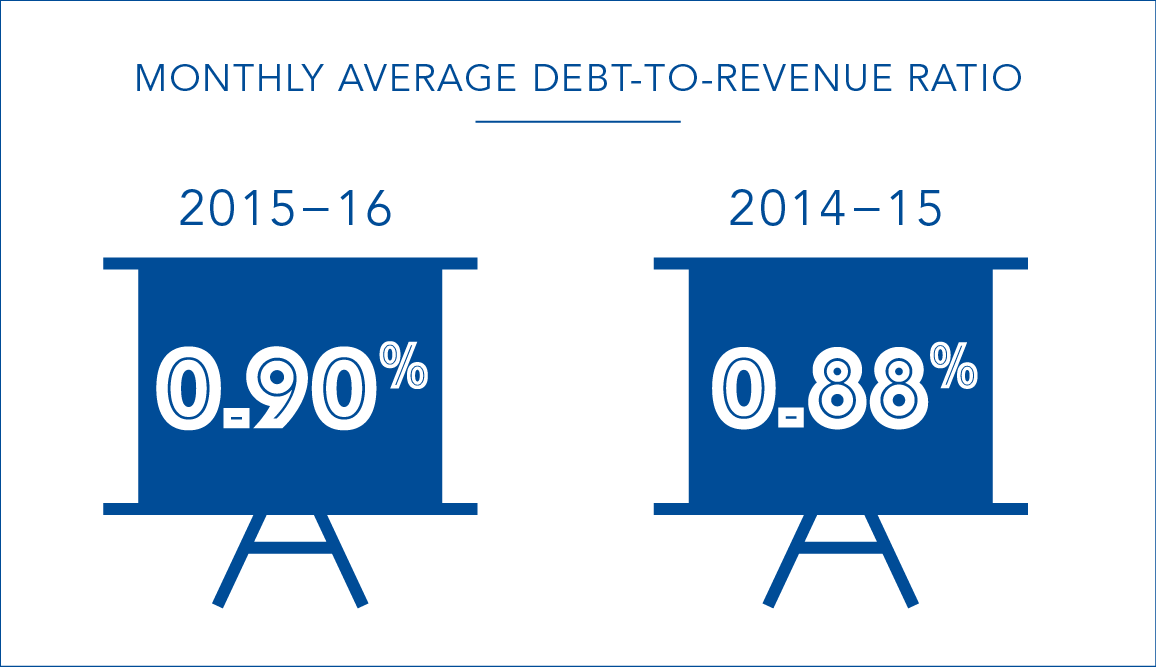

In real terms, our debt level is consistently below 2 per cent of the total revenue collected in a year. The current average for OECD countries is 21.4 per cent, reflecting our consistently high performance standards in maintaining debt at remarkably low levels.

This year, we achieved our debt-to-revenue ratio despite an increasing customer base, growth in revenue receipts, and a truncated 2016 land tax issue cycle of eight weeks. We also increased our focus on resolving smaller value, but larger volume, land tax debts, resulting in the resolution of older cases.